library(readr)

data <- read_csv("data.csv")

data <- as.data.frame(data)

row.names(data) <- data$stock

dataStock Return and Fundamental Clustering & Portfolio Selection

Introduction

We have following features for BIST30 stocks:

Momentum 3-months, 6-months, 1-year

Volatility 1-year, 2-year, 3-year

Price-To-Book Ratio

Market Capitalization

Return On Equity

Earnings Growth

We need to standardize the features:

```{r}

library(scales)

cols <- 5:ncol(data)

data_scaled <- lapply(data[, cols], function(x) if(is.numeric(x)) rescale(x, to=c(0,1)) else x)

data_scaled <- as.data.frame(data_scaled)

data_scaled <- cbind(data[,1:4], data_scaled)

row.names(data_scaled) <- data_scaled$stock

data_scaled$stock <- NULL

data_scaled

```Earnings Growth column has NA values, replace NA’s with zero:

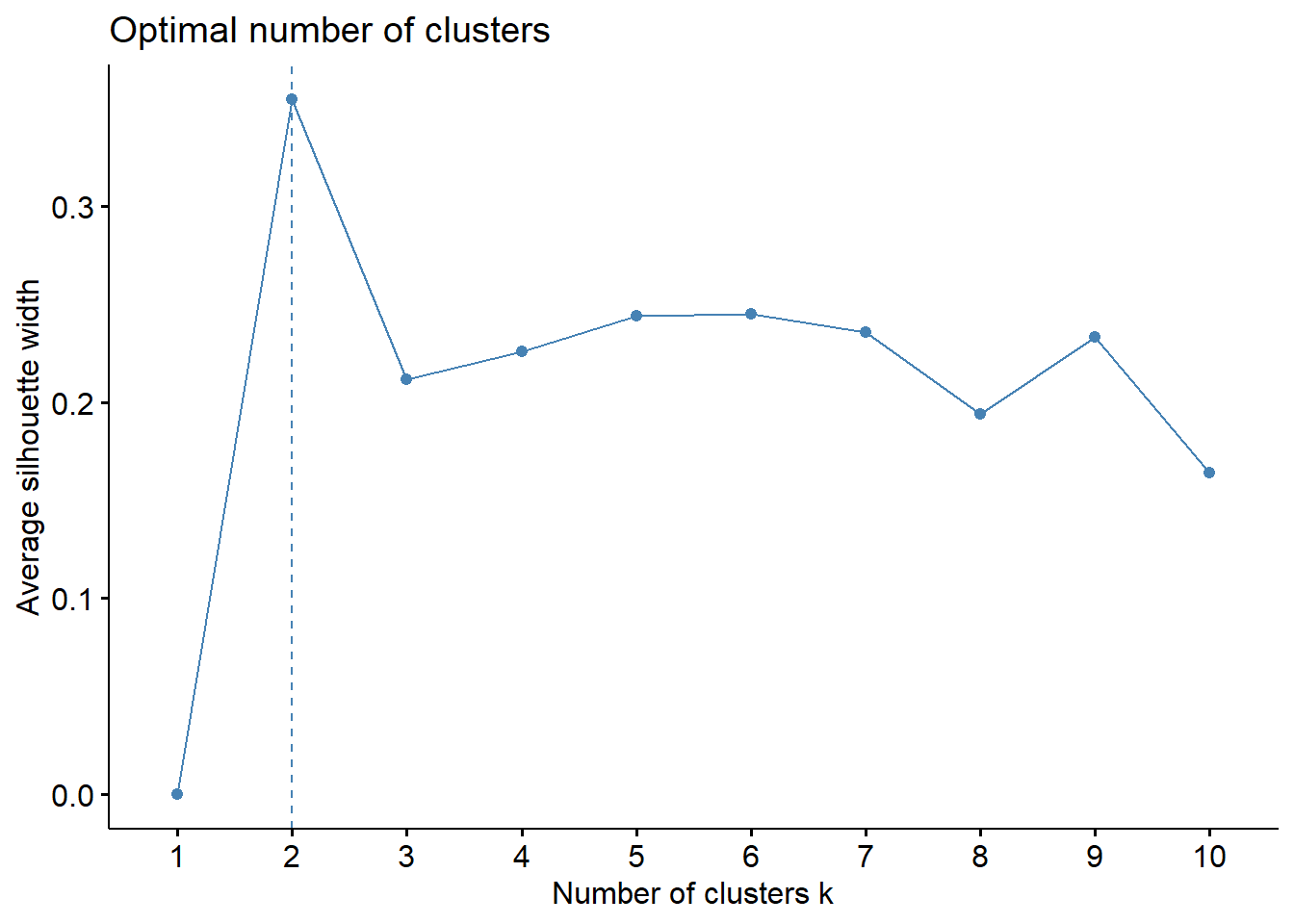

data_scaled$earningsGrowth[is.na(data_scaled$earningsGrowth)] <- 0We will use K-means method. Let’s calculate silhouette score for optimal cluster count:

library(factoextra)

library(cluster)

fviz_nbclust(data_scaled, kmeans, method = "silhouette", k.max = 10)

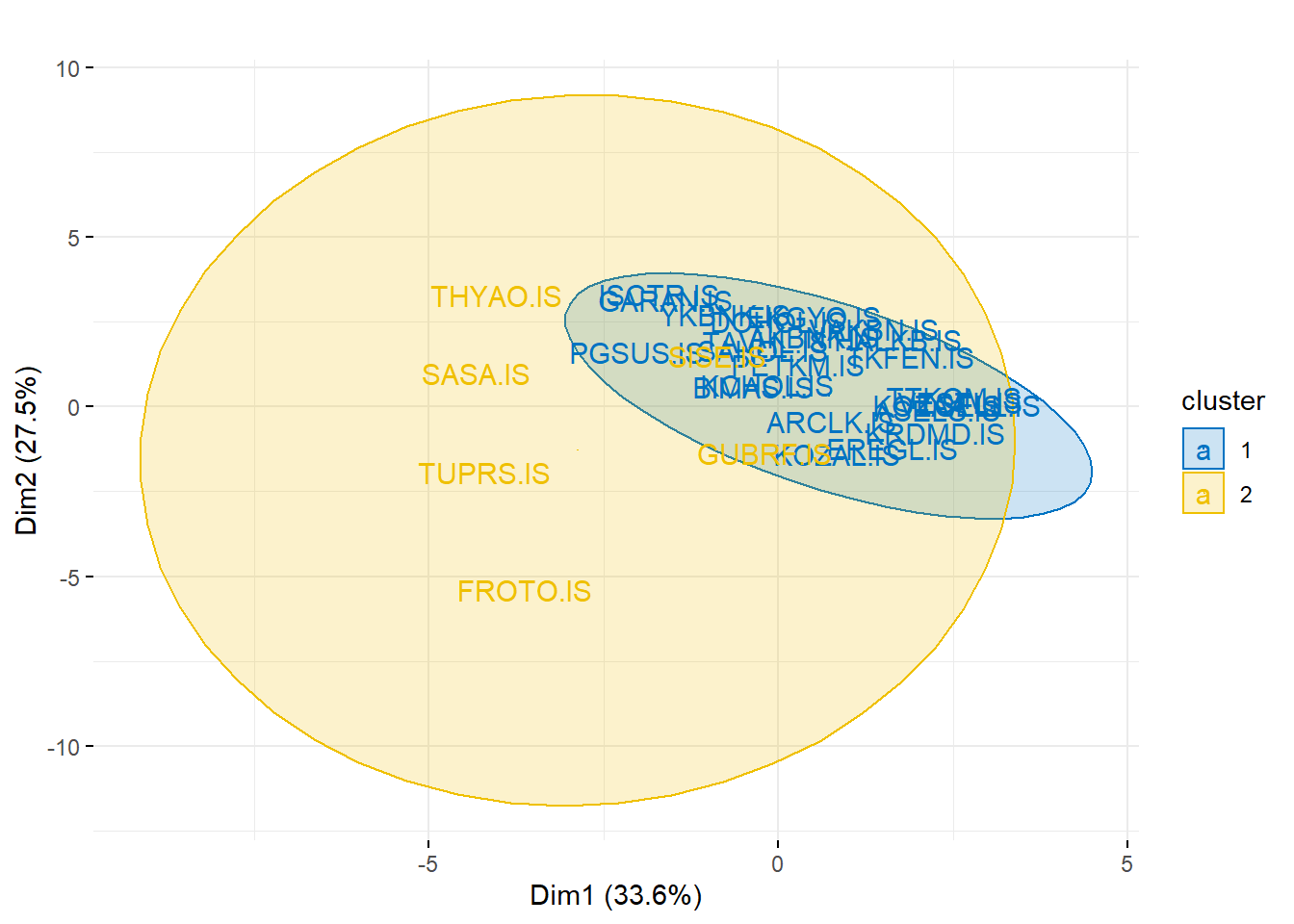

We have two different clusters, let’s fit model and see results:

model <- kmeans(data_scaled, 2)

fviz_cluster(object = model,

data = data_scaled,

ellipse.type = "norm",

geom = "text",

palette = "jco",

main = "",

ggtheme = theme_minimal())

Statistics:

modelK-means clustering with 2 clusters of sizes 24, 6

Cluster means:

return1y return2y return3y momentum_3m momentum_6m momentum_1y

1 0.5021594 0.6856488 0.9261702 0.5014242 0.4282937 0.3035298

2 0.6812538 1.2212164 1.8785916 0.5867881 0.5896588 0.4708884

volatility_1y volatility_2y volatility_3y priceToBook marketCap

1 0.1032558 0.0909333 0.07866424 0.03512632 0.3220344

2 0.4404008 0.4355551 0.39217887 0.34549470 0.6317486

returnOnEquity earningsGrowth

1 0.3900359 0.1203581

2 0.5562222 0.2889656

Clustering vector:

TUPRS.IS VAKBN.IS KRDMD.IS DOHOL.IS AKBNK.IS TKFEN.IS FROTO.IS GARAN.IS

2 1 1 1 1 1 2 1

KOZAA.IS HALKB.IS TCELL.IS KOZAL.IS VESTL.IS YKBNK.IS TTKOM.IS BIMAS.IS

1 1 1 1 1 1 1 1

PETKM.IS ARCLK.IS EREGL.IS SAHOL.IS EKGYO.IS THYAO.IS PGSUS.IS ISCTR.IS

1 1 1 1 1 2 1 1

KCHOL.IS ASELS.IS TAVHL.IS GUBRF.IS SISE.IS SASA.IS

1 1 1 2 2 2

Within cluster sum of squares by cluster:

[1] 14.45341 10.20335

(between_SS / total_SS = 26.7 %)

Available components:

[1] "cluster" "centers" "totss" "withinss" "tot.withinss"

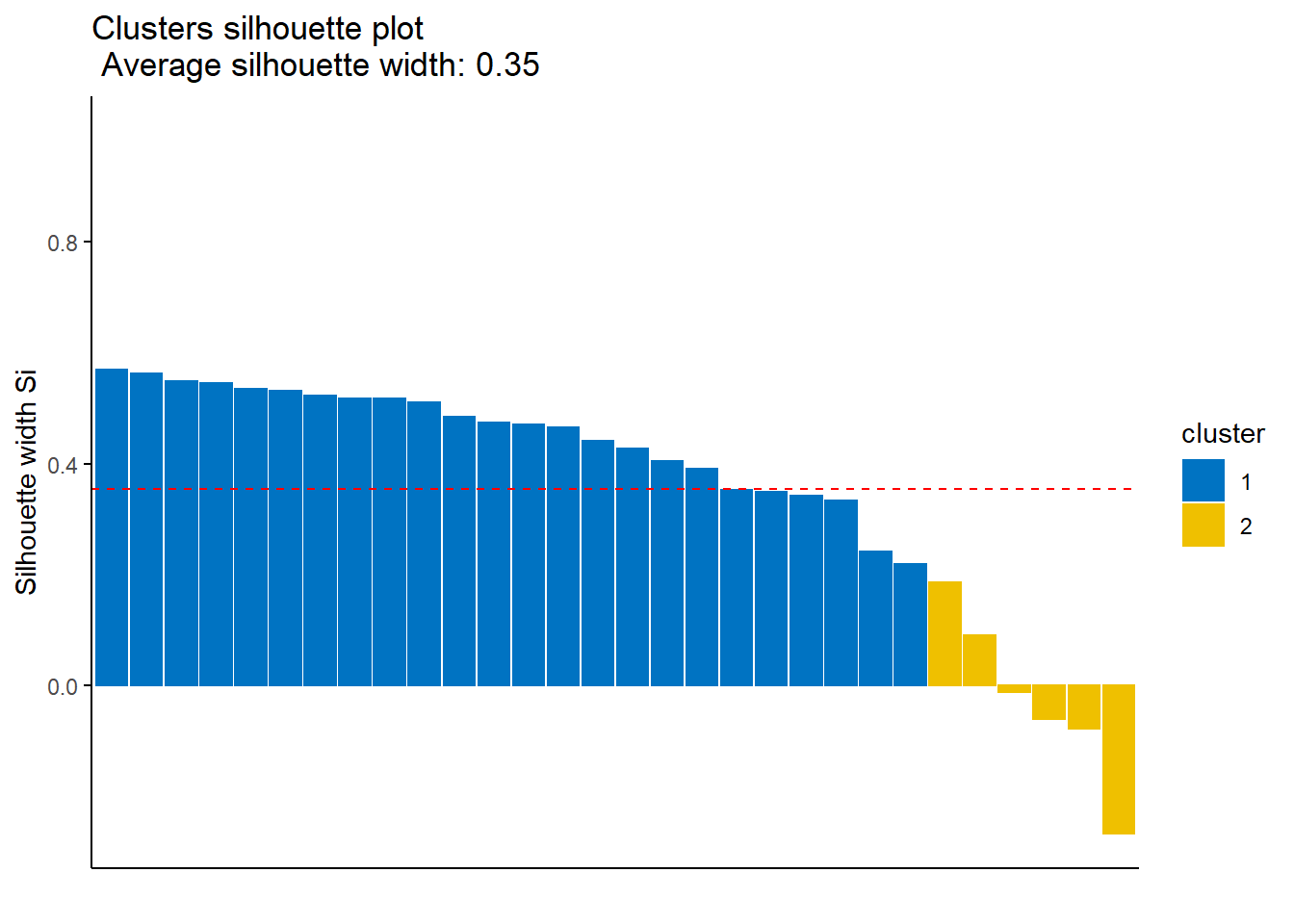

[6] "betweenss" "size" "iter" "ifault" sil <- silhouette(model$cluster, dist(data_scaled))

fviz_silhouette(sil, palette = "jco", ggtheme = theme_classic()) cluster size ave.sil.width

1 1 24 0.45

2 2 6 -0.02

There are negative silhouette scores, it indicates that it may be in the wrong cluster.

Let’s look the mean return statistics of each cluster:

library(dplyr)

predicted_clusters <- data.frame(predicted_cluster=model$cluster, row.names=names(model$cluster))

data_clustered <- merge(data, predicted_clusters, by=0)

data_clustered %>%

group_by(predicted_cluster) %>%

summarise(

mean_1_year_return = mean(return1y),

std_1_year_return = sd(return1y),

mean_2_year_return = mean(return2y),

std_2_year_return = sd(return2y),

mean_3_year_return = mean(return3y),

std_3_year_return = sd(return3y),

)Full source code: https://github.com/mrtkp9993/MyDsProjects/tree/main/StockClustering

References

\(^1\) https://www.investopedia.com/terms/c/cluster_analysis.asp

\(^2\) https://www.investopedia.com/terms/f/factor-investing.asp

Citation

@online{koptur2022,

author = {Koptur, Murat},

title = {Stock {Return} and {Fundamental} {Clustering} \& {Portfolio}

{Selection}},

date = {2022-08-26},

url = {https://www.muratkoptur.com/MyDsProjects/StockClustering/Analysis.html},

langid = {en}

}